We’re all familiar with the following scenario: You’re at a local chain restaurant, probably an Outback Steakhouse, sometime in the early evening, preparing to give a pitch to a room full of hungry onlookers, who, let’s face it, are probably more interested in the ensuing $20 steak than your talk.

Isn’t it time for something different?

Well, it certainly was for Eric Peterson, President of Peterson Financial Group and a Financial Educators Network instructor for the past 10 years, who spoke with FMT as part of our Leading with Education webinar series. He and Nick Schilling, CEO of FMT, had a great conversation, showcasing the immense potential a focus on education can create for the independent financial advisor.

Using Education to Build and Strengthen Client Relationships

When you spend hours of time with potential clients in the classroom setting, you’re doing much more than educating them on their financial planning opportunities. You’re also building rapport with them, advancing you further along in that client relationship than any dinner seminar ever could.

Additionally, when a potential client is making the commitment to give up several hours of their life to attend your class, even paying a fee to do so, you’re ensuring the people who attend will be attentive to what you are saying. Ultimately, when they decide to engage you as a financial advisor after the class has concluded, they’re already further along in the process of understanding than the average person coming in from cold marketing outreach. For example, rather than having 6 sessions with one individual potential client, this format offers the opportunity to have 6 sessions with an entire classroom of potential clients. This enables you to scale your time to get to the heart of their unique financial situation more quickly and efficiently.

What You Give Comes Back to You

One of education’s biggest impacts is the way in which it bolsters not only an individual, but their entire family, with strong financial knowledge. By showcasing your skills and expertise via the classroom, you’re engaging with people in a much more intimate and tailored setting than a traditional dinner seminar. They are much more likely to remember what’s being said, taking that information home with them to share with others.

Eric shared that though not every individual who takes your course is going to immediately hire you as a financial advisor, there is a long-term return on investment that is unique to the educational setting. Keep everyone that attended on your mail list, keep reaching out, and you will be surprised to see the number of people who come back to you ready to start a relationship. “We’ve had people that come back four or five years later . . . you have to treat the classes akin to farming seeds. It may take a long time before they get harvestable, but, man, when they’re harvestable, it’s so easy when someone calls you and says ‘Hey, I met with you a couple of years ago at one of your classes, and I’m ready to move that relationship forward,” Eric said.

Don’t Just Talk the Talk, Walk the Walk – Presenting Yourself as a True Teacher

As a tenured instructor with FMT, Eric had a wealth of tips and tricks for teaching financial education courses. Throughout his conversation, he stressed the importance of coming across as a true teacher, not a salesperson, with education as the focus. This is the kind of attitude that builds trust, increases your credibility quickly, and leads to strong, long-term client relationships.

Eric’s advice includes the following:

- Be genuine. People want to connect with you, so make it easier to do so. Take off your jacket, roll up your sleeves, be approachable.

- Use real world examples. Incorporating examples makes the content come to life and help with retention. Attendees will remember the examples more than the materials. Additionally, bring in other types of content, like videos.

- Ask questions. Not only does it promote engagement, but it also helps attendees get more comfortable with you and let their guard down.

- Answer any question. Don’t hold back information if you have it. Give it away and it will come back to you.

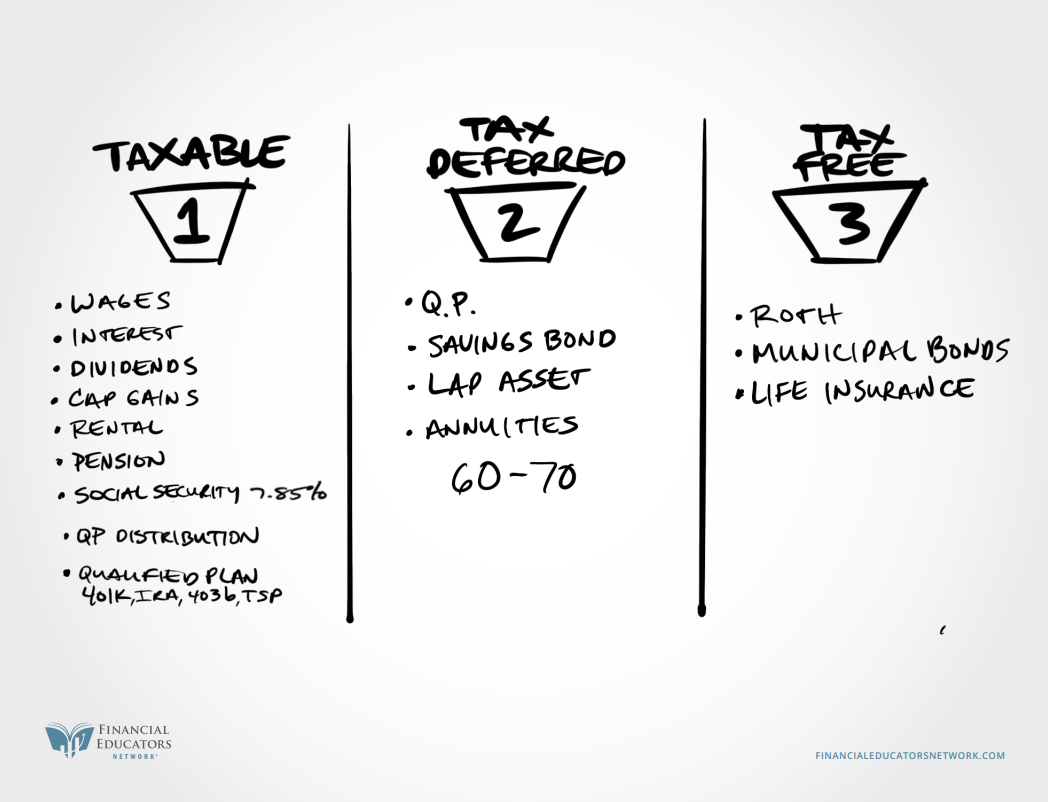

- Use a whiteboard. This is a power tool for engaging the class and showing your mastery of the information. Use it to illustrate examples or concepts you want to get across, even if they are already in the book.

Education is the Answer

Advisors like Eric make it clear – using education as a tool to engage with prospective clients is powerful and worthwhile. By creating a designated space for interested individuals to be exposed to your expertise, you are fostering not only their financial understanding, but encouraging them to think about their own unique situations more seriously. Once your class concludes, these students are much more likely to approach you for 1-1 consultation, whether it’s right away or sometime in the future.

Below is an example of how Eric showcases his expertise in the classroom, by writing out helpful information on a whiteboard and then explaining it and answering any questions that may arise.

Remarking on his perspective on teaching and why it matters Eric stated, “I like helping people [and] I carry that same mentality into financial services. I'm here to help people. And we'll help people even though sometimes we don't make a dime off that. I'll still give them the best information I know. I want to help empower people to make the best decisions that they can.”

Make sure to keep up to date with our Leading with Education series to learn even more about how our advisors are using education to grow their practices. To watch this webinar in full, click here.